PAN Card Apply Online 2026 – Step by Step Process, Documents Required

Post Date : 18 February 2026 | 5:52 PM

If you still don’t have a PAN card, here is good news. The Income Tax Department now provides an Instant e-PAN allotment service that allows eligible individuals to get a PAN Card in just 10 minutes, completely online and free of cost.

This new facility works through Aadhaar-based e-KYC verification, so there is no need to fill out long forms or submit physical documents. Everything is digital, simple, and fast.

What is Instant e-PAN?

Instant e-PAN is an online service launched by the Income Tax Department that enables individuals to apply for PAN Card online using Aadhaar.

Once approved, the PAN is issued in PDF format with a secure QR code containing your demographic details such as:

- Full Name

- Date of Birth

- Photograph

The e-PAN soft copy is sent directly to your registered email ID, and you can also download it using your acknowledgement number from the Income Tax e-Filing portal.

How to Apply for Instant e-PAN Online

- Visit the official Income Tax e-Filing portal – www.incometax.gov.in

- Click on Instant e-PAN under Quick Links.

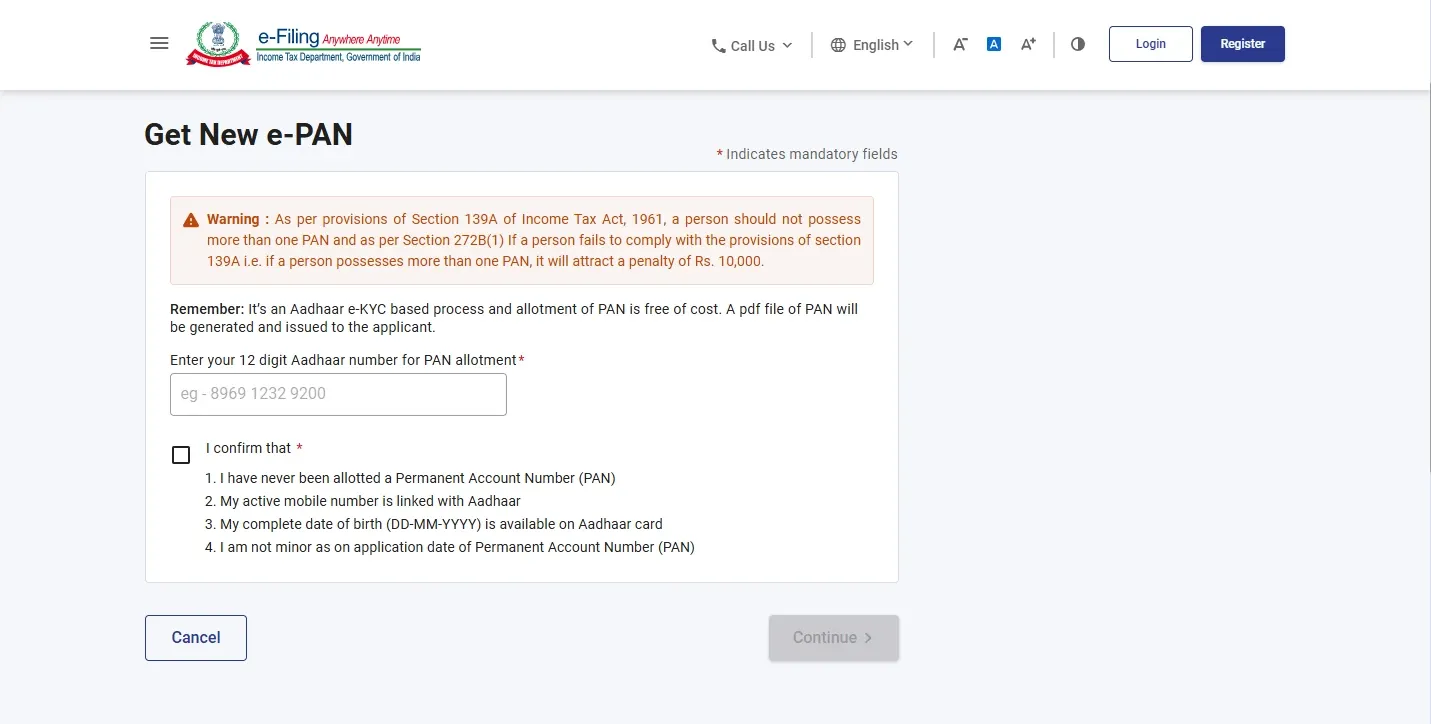

- Select the Get New PAN option.

- Enter your Aadhaar number and confirm the declaration.

- Verify using the OTP sent to your registered mobile number.

- Confirm your details and submit the request.

Also read : Bihar Udyami Yojana 2026 apply date

How to Check Instant PAN Status / Download e-PAN

- Visit the e-Filing portal.

- Click on Instant e-PAN.

- Select Check Status / Download PAN.

- Enter your Aadhaar number and verify via OTP.

- Then download your PAN Card from here.

| Join Our WhatsApp Channel | Follow Now |

| Follow Our Instagram Channel | Follow Now |

SOME USEFUL IMPORTANT LINKS

| Apply Online | Click Here |

| Check Status/ Download e-PAN | Click Here |

Frequently Asked Questions

What is Instant e-PAN?

Instant e-PAN is a free service by the Income Tax Department that allows eligible individuals to get a PAN card online within minutes using Aadhaar-based OTP verification.

Who can apply for Instant e-PAN?

You can apply if you meet the following conditions:

- You have never been issued a PAN before

- You are not a minor

- You have a valid Aadhaar linked with mobile number

- Your Aadhaar has full date of birth

Is Instant e-PAN really free?

Yes. The Instant e-PAN service is completely free and does not require payment or third-party agents.

How long does it take to get Instant PAN?

In most cases, the e-PAN is generated within 10 minutes after successful Aadhaar OTP verification.

How can I apply for Instant e-PAN?

Visit the official Income Tax portal and apply online here: Income Tax e-Filing Portal.

How can I download my e-PAN after applying?

You can download it by selecting “Check Status / Download PAN” on the portal and verifying your Aadhaar using OTP.

What is the password to open e-PAN PDF?

The e-PAN file is password protected. Use your Date of Birth in DDMMYYYY format as the password.